owner draw quickbooks s-corp

This adapted edition is produced by the University of Minnesota Libraries Publishing through the eLearning Support Initiative. The company contributions would be treated as business expenses as would your payroll of course.

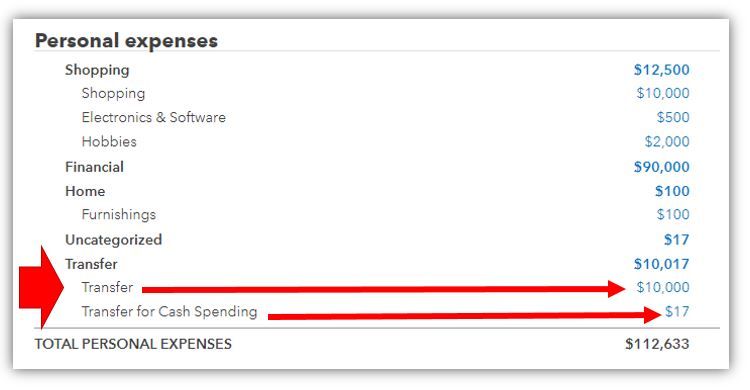

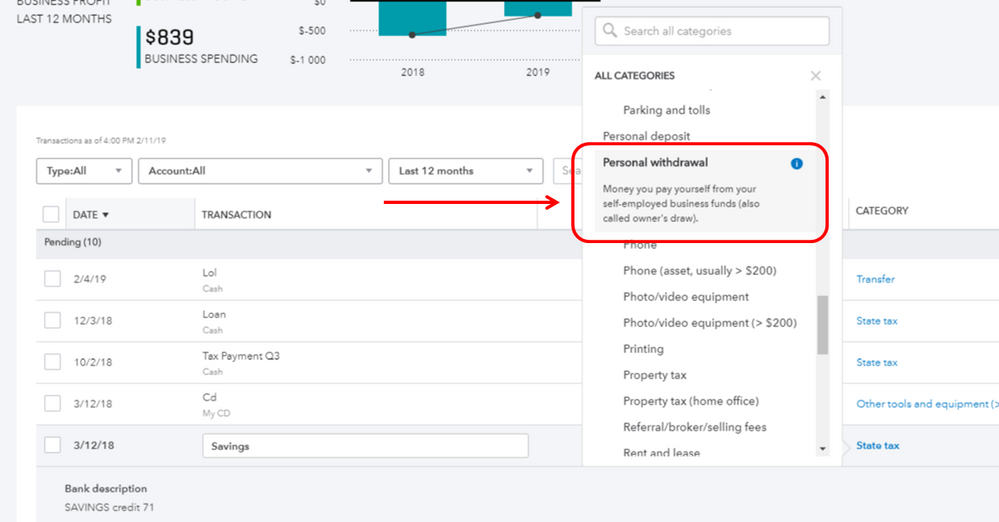

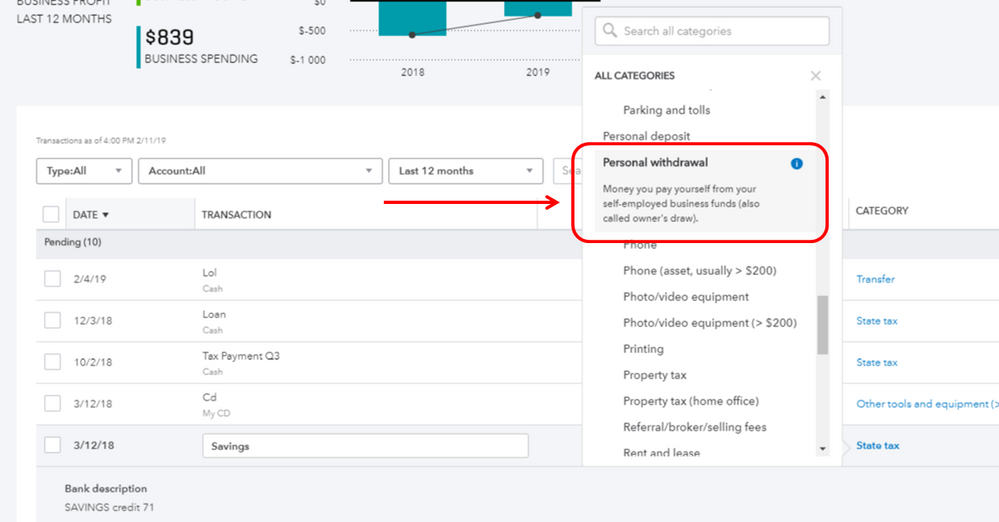

Solved Owner S Draw On Self Employed Qb

But this decision is tricky.

. You each could draw payroll and have 401k plans that the S-Corp can make contributions to up to 25 of your compensation. Setting S Corp Shareholder Salaries. You could also set up an accountable plan to reimburse your for the use of your home office.

To maximize the tax savings from an S corporation you need to minimize the salary paid to shareholder employees. The reimbursement would be tax-free to you. In subscribing to our newsletter by entering your email address you confirm you are over the age of 18 or have obtained your parentsguardians permission to subscribe.

Set the salary too low and you run the risk of an IRS examination and then penalties. Set the salary too high however and the situation is even worse. Principles of Management is adapted from a work produced and distributed under a Creative Commons license CC BY-NC-SA in 2010 by a publisher who has requested that they and the original author not receive attribution.

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

Solved S Corp Officer Compensation How To Enter Owner Eq

Solved Owner Has Been Incorrectly Taking Owners Draw Inst

Solved Owner S Draw On Self Employed Qb

Quickbooks Owner Draws Contributions Youtube

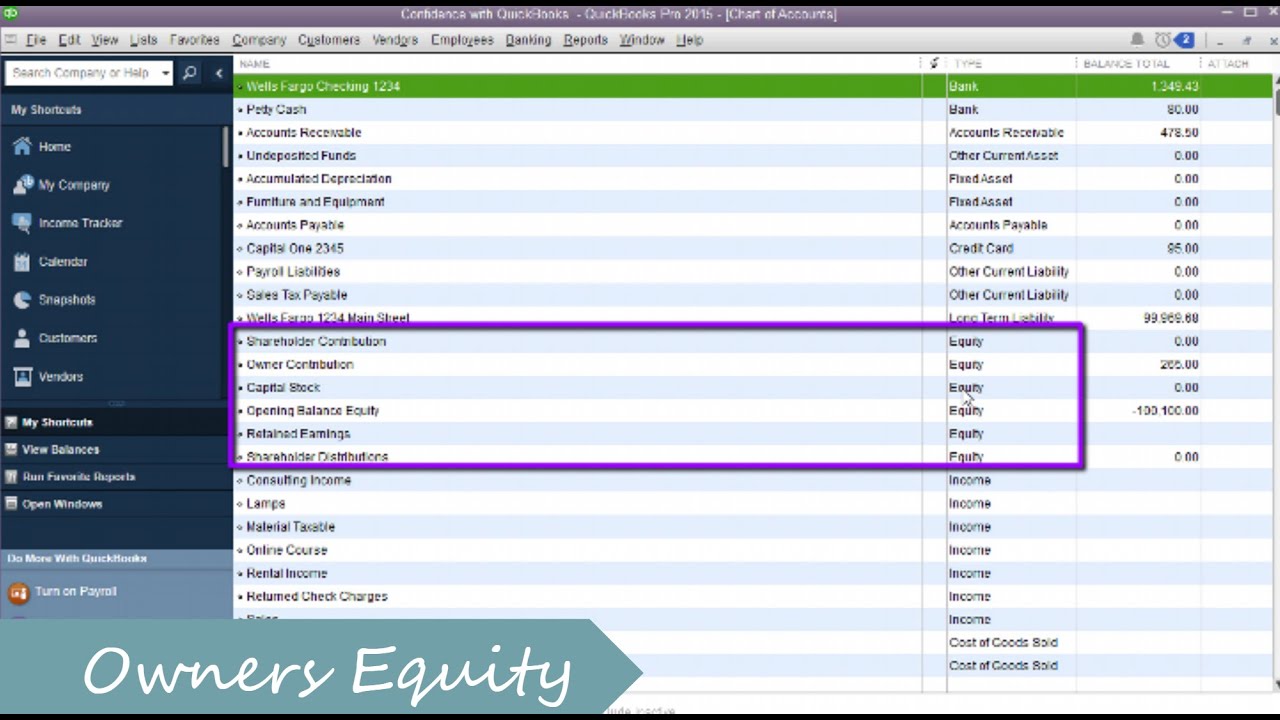

How To Setup And Use Owners Equity In Quickbooks Pro Youtube

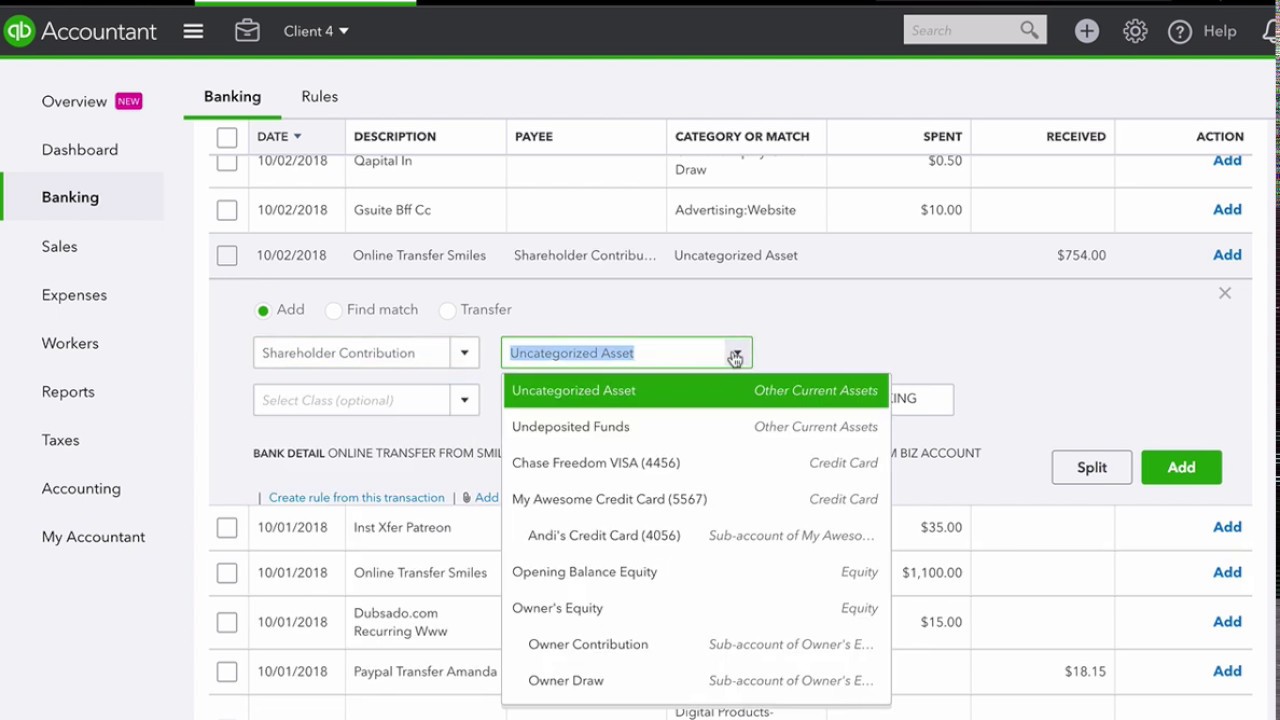

How To Categorize Shareholder Distributions And Contributions In Qbo Youtube

How To Record Owner S Equity Draws In Quickbooks Online Youtube